Mario Gonzalez blog posts

Status of Real Estate headed into 2023

Status of Real Estate headed into 2023

Jason Lewris from Parcl states, “In the absence of trustworthy up to date information, real estate decisions are increasingly being driven by fear, uncertainty and doubt.”

Real estate decisions can be hugely consequential for consumers and for businesses. If you don’t know the truth about the market you can make an irrational decision. If you read a headline or somebody tells you something that isn’t true it can cause you to be fearful, uncertain, or doubt whether you should or shouldn’t buy a home. This fear can cause you to make a catastrophic mistake. Irrational decisions can end up costing thousands of dollars over the long term.

As an expert realtor, my job is to educate you with the facts of the market, and help you feel confident about your real estate decision, one way or another. This month’s blog post is about the current state of the economy, and what we can expect for 2023. So lets dive in and see what the data tells us, and what history suggests may happen in 2023.

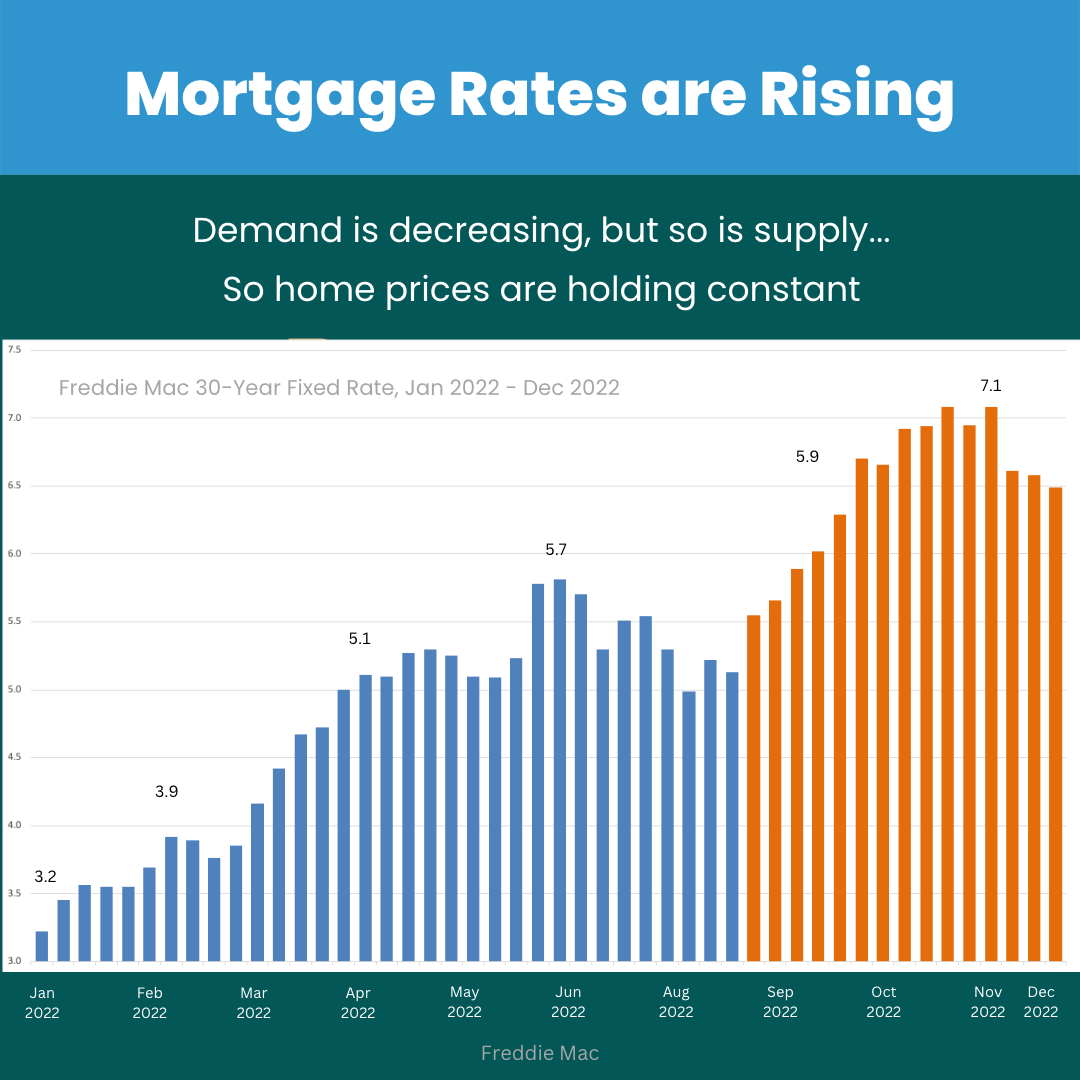

Mortgage Rates

2022 was a unique year as it pertains to mortgage rates. Mortgage rates have more than doubled in last 12 months. That has never happened before in a calendar year. The pain that people are feeling is not necessarily because rates have gone up from historically low levels, but because rates are rising so fast. This is causing people to pause their plan, and ask the question, “Do I really want to buy right now?” The result is a cool down in the market. The big question people are asking is, will mortgage rates keep rising?

At the end of the day the rapid increase in mortgage rates is all about inflation.

The Federal Reserve is making moves to raise the federal funds rate. They’re trying to lower inflation and slow down the economy. The FED doesn’t control the mortgage rates, but mortgage rates tend to follow the Fed. And that’s exactly what’s happening. It’s what we’ve been saying for the bulk of the year now that while inflation is high, mortgage rates are going to remain high. The good news is we’re not expected to see this exponential increase as we continue to go forward. We are not talking about mortgage rates doubling again next year.

This leads to the question of whether or not a recession is around the corner. In a recent survey the Wall Street Journal reports 63% of economists feel that there’s going to be a recession sometime over the next 12 months.

If a recession does arrive sometime in 2023, what does that mean for the housing market? It’s important for consumers to be educated and avoid falling prey to knee jerk reactions and fear. There is a lot we can learn from history. Keep in mind that a recession does not mean falling prices. In four out of the last six recessions in this country, home prices actually increased.

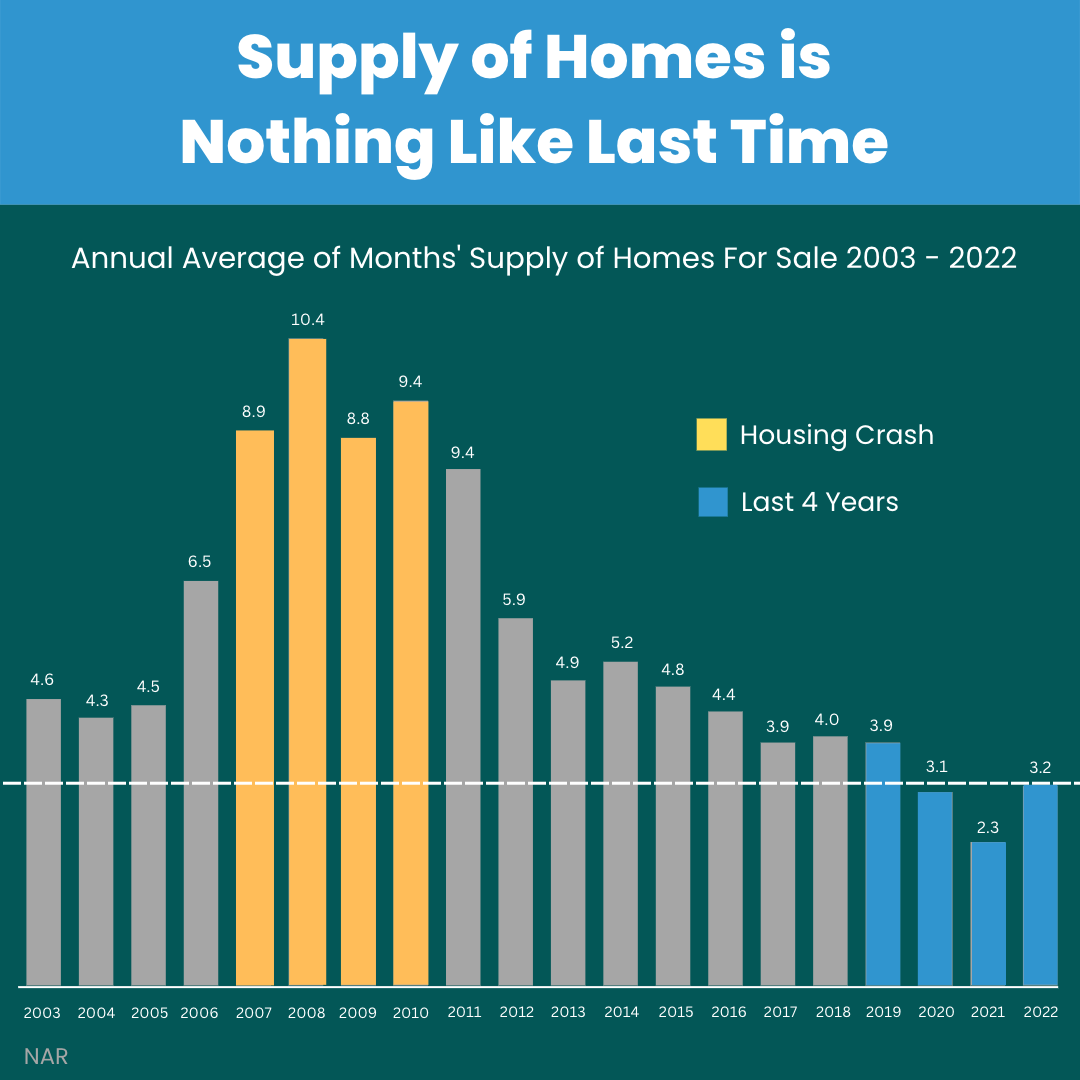

Now, we all remember the housing crash in 2008, and I think that’s fresh on everyone’s minds and people are fearful of that. But we have to remember we have a very different landscape right now when it comes to inventory, when it comes to lending standards, and when it comes to home equity. These factors are driving the housing market in a different direction here in 2022 than we had in 2008. We are in a much better situation now than we were back then.

If a recession is in play, we have to put this in context. History tells us that a recession more likely means falling mortgage rates. In the last six recessions, mortgage rates have also dropped each time. When the word “recession” is heard, there is frequently a lot of emotional reactions, but history also shows us that if the economy does go into a recession, mortgage rates will decrease, helping to stabilize home prices. We are keeping our eye on rates, because there is a lot of fear and uncertainty in the market right now.

Home Prices

So what does all of this mean for home prices? Let’s take a look at what Redfin says, “For those bearish folks eagerly awaiting the home price crash, you’ll have to keep waiting. As much as demand is pulling back, supply is as well. And that’s reducing downward pressure on prices in the short run.”

What does this mean? This means houses are staying on the market longer. We’re not seeing an influx of new listings. There is still more demand than there is supply, which makes it a seller’s market.

Some experts are projecting a little bit of appreciation in 2023. But other experts are projecting slight depreciation. So across the board it’s; a little bit up, a little bit down, depending on how experts are looking at it. We feel those overheated markets where prices went up so rapidly during the pandemic may see a downward in prices this year, while other markets are that didn’t see a rapid rise, will hold steady. When we average these out across the year, we predict roughly flat home price appreciation for 2023. And when 2024 arrives we expect to return to more normal levels of home price appreciation.

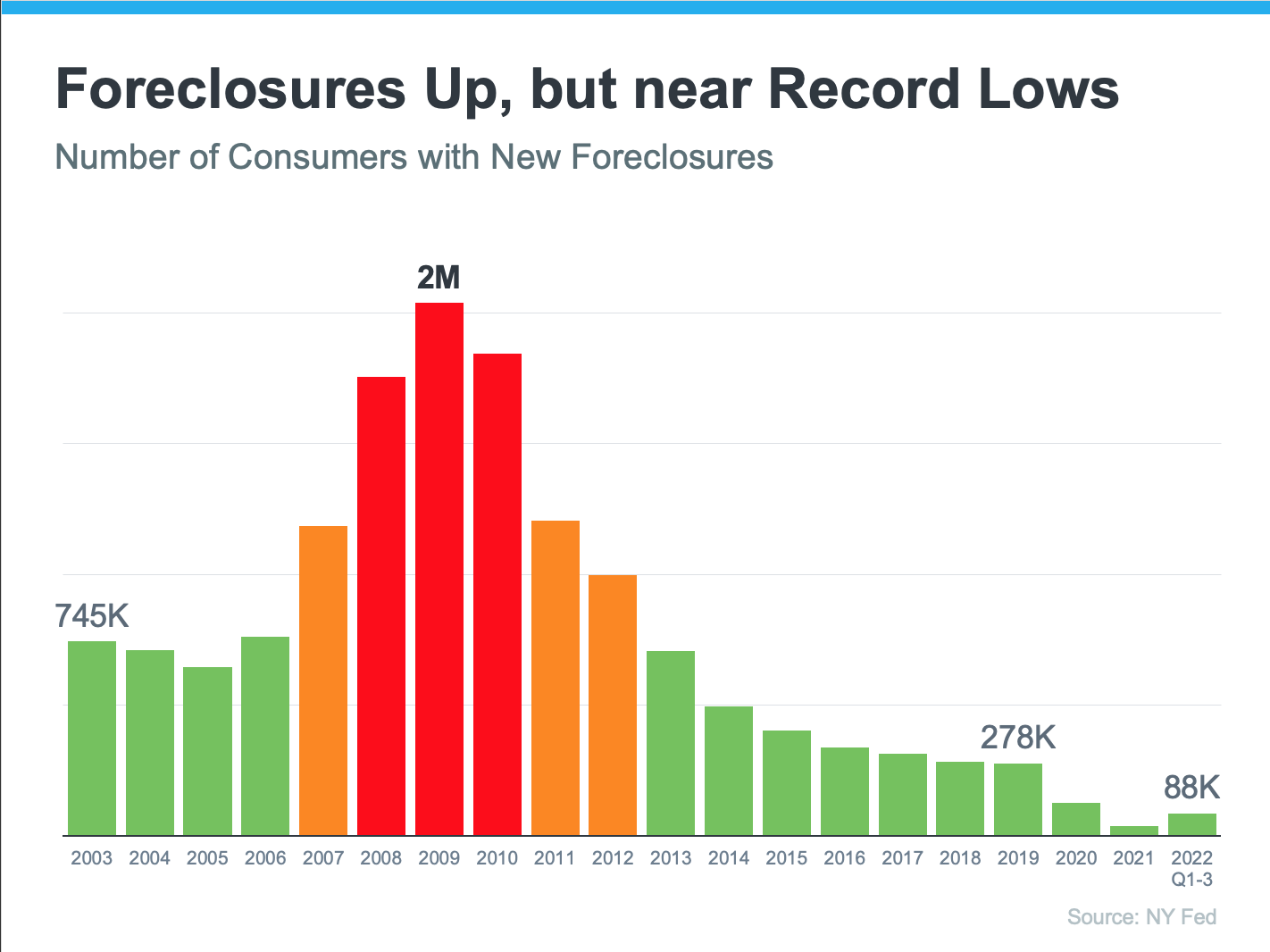

Foreclosures

If you look at foreclosure data going back to 2005, the data shows something very interesting. Ever since 2010 the number of foreclosures have decreased in the United States, and there is a reason for that. Leading up to the financial crisis of 2008, lending standards had been loosened, with the goal of increasing home ownership. This caused more people to buy houses that were not really qualified to get a loan. Over time more and more people couldn’t pay their loan and defaulted on their mortgage, which ultimately led to the financial crash of 2008. Coming out of the financial crisis of 2008, lending standards became a lot stricter, which resulted in a better qualified borrower. Aside from the covid years, every year since 2010 we have seen less and less foreclosures in the United States.

Conclusion

Inflation hit 2022 hard and mortgage rates rose rapidly as a result. The good news is, we don’t expect that to continue in 2023, at least not at the same pace it did this past year. Most economists expect 2023 will see some sort of recession. But just because we experience a recession, does not mean that home prices will decrease. As we stated above, in four of the last six recessions home prices actually increased. We can learn a lot from history, and we are in a very different situation today than we were in 2008. Today, home supply is very low, compared to 2008 when home supply was at an all-time high. That supply is keeping prices stable, and we expect that to continue in 2023.

If you are interested in making a move but are feeling fearful of the economy and all the news you have been hearing lately, rest assured that things may not be as bad as they appear. If you have any questions about real estate, please feel free to give me call, and we can talk through your specific situation.

Sources:

https://blog.firstam.com/economics/

https://www.fanniemae.com/

https://www.bankrate.com/

https://www.nar.realtor/

Mario Gonzalez

7 Ways You Can Share the Spirit of the Season

This time of year our homes are filled with lights, laughter and joy as we celebrate the holiday season once again. Trimming trees, sharing gifts, stockings by the fireplace, all little things that warm our hearts and bring back childhood memories.

The joy that starts in our home can be spread outward into our community as we share the season of giving with those around us. If you’ve always been wanting to reach out and share with others, but haven’t known how to start, here are some ideas to get you started! Most of these things can be done with little effort but will go far in spreading joy to those around you.

Host a Holiday Party

If you’ve never done this before it can sound daunting, but you can actually do this without too much work or expense.

Set up a dessert night! You provide the tableware and hot drinks. Invite neighbors, family and friends and ask everyone to bring their favorite dessert. Put on some holiday music and let everyone mingle and enjoy an evening with friends.

If you want a full meal you can still do this simply by setting up a baked potato or nacho bar. Have lots of toppings! Provide nametags and some simple games or a have everyone bring a small item or ornament for a gift exchange.

Most people decorate their home this time of year with holiday decorations, trees and lights so it’s a perfect time to invite people into your home for a small festive gathering.

Support First Responders

Most people get the holidays off to spend with their families, but there are a group of essential workers that don’t always get to do that. Plan to drop off a Christmas meal or tray of cookies to your local police station, fire station, hospitals or anyone else that you know will be working that day. One group of neighbors collaborated to bring a meal each day in December to their local fire station. Find a simple way to honor and help those who dedicated their lives to serving their community. Collect stuffed animals and drop them off at any of these locations. First responders can keep some in their vehicles and use them to comfort children that may be involved in accidents or other incidents. Hospitals also appreciate these to give out to children, especially during the holiday season.

Bags for Homeless

Put together goodie bags to pass out to homeless individuals you may encounter. You can pick up any kind of reusable tote bag at a local dollar store or you can use grocery bags or gallon zip lock bags and fill with some of the following items:

-

Water Bottle

-

Toothpaste/Toothbrush

-

Beef Jerkey

-

Granola Bars

-

Socks

-

Gum/Mints

-

Nail Clippers

-

Lotion/Hand Sanitizer

-

Baby Wipes

-

Crackers and Cheese or Peanut Butter Packets

-

Tuna and Cracker Packets

-

Deodorant

-

Fleece blanket

For a special touch, add a handwritten note of encouragement, hot chocolate or hot ciders packets, and a few dollar bills. You can keep these in your car year round to distribute, but during the holiday season this can be an especially great way to share a gift of kindness with those around you.

Treats for Your Mail and Package Delivery People

With Amazon and online shopping being so popular, you may have deliveries at your house often throughout the month. Delivery drivers work long hours and often into the night. Show them your appreciation by putting out a basket of snacks and drinks by your front door. Post a note somewhere easy for them to see to say thank you and suggest they take a treat for the road.

Tip Generously

We often race through our list of holiday activities and shopping to get everything done quickly. A trip to your local coffee shop, a bite to eat, getting a haircut, an uber order for dinner. We run into people all day long who continue to serve with a smile. The holidays are a perfect time to show them some extra gratitude by tipping generously. Everyone could use a little extra cash around the holidays. If you can afford it, be generous. Your kindness will go a long way and be a blessing to others.

Quoting from an article in US News & World Report, “Holiday tips can vary depending on the service, your relationship with the worker and regional customs. "It should be something more meaningful than just your change," Gottsman says.

The following represent generally accepted holiday tipping standards, according to Gottsman:

-

Restaurant delivery drivers: 20% of the total bill or $5, whichever is higher.

-

Babysitters or nannies: One evening or one week's pay, respectively.

-

Hairstylists or beauticians: Equivalent to one visit.

-

Door attendants: $20 to $100, depending on the level of service provided.

-

Maintenance workers such as housekeepers and landscapers: One week's pay.

-

Repair people: $20 to $100.

-

Newspaper carriers: $10 to $30.

-

Trash collectors: $10 to $25 per person, if allowed.

-

Dog walkers: One day or week's pay.

-

Dog groomers: Equivalent to one visit

Helping a Neighbor

What better time than the holiday season to reach out to help a neighbor in need. Many of your elderly neighbors may find keeping up with their yardwork difficult. While you are taking care of your own lawn, offer to help rake leaves or shovel snow from their driveway. If you have a neighbor that has been sick or had surgery, dropping off a meal or offering to pick up something from the grocery store for them can be a huge help.

If you don’t know your neighbors, the holiday season is a perfect time to take a plate of cookies and go introduce yourself. A simple kind gesture can go a long way in building relationships and bringing some holiday cheer to the people around you.

Volunteer at a local organization

Visit a nursing home – Some elderly find the holidays to be a lonely time. Grab some friends and bring a plate of cookies or take your kids along to sing a few Christmas carols, visit and spread some holiday cheer.

Serve at an area shelter – Contact a local shelter in your area to volunteer to serve a meal or help with a project. This sounds easy enough but it’s a popular thing for families to do during the holidays, so make sure to call in advance to arrange a time.

Collect winter clothes for the homeless – Purchase some new items, or gather any extra winter jackets, gloves, scarves, boots or items that you may not be using and donate them to a homeless shelter. You can also keep some in your car to give out if you come across someone that could use the extra warmth.

Drop off blankets and new toys at a children’s hospital – Unfortunately some kids will end up in the hospital over the holidays, some briefly and others for an extended period of time. A new toy, gift or activity book can really brighten their day.

Though the holiday season can be hectic and overwhelming, taking the time to slow down and be intentional about serving others may be just what you need to remind yourself and those around you what the Spirit of the season is all about.

Sources:

https://themadf.org/remembering-

Mario Gonzalez

Buy, Sell or Wait?

Home prices have seen a sharp rise over the last 2 years and today’s mortgage rates are at a 14 year high. Many people are wondering if now is the time to buy, sell or simply wait for the housing market to settle down. The decision to buy now can be a stressful one, but waiting too long can present a different set of challenges. There are several things you should evaluate as you consider the best option for you.

Should I buy now?

One of the first things you should consider is your current financial situation. There are three questions you should ask yourself.

-

1. What does my credit score look like? According to Bankrate.com “Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions. Typically, the higher your score, the lower the interest rates and better terms you'll qualify for.”1 A higher score gives a lender confidence that you will make your payments on time. The good news is even if your credit score isn’t the best, there are immediate steps you can take to begin to raise your score.

-

2. Have you saved for a downpayment? The larger your downpayment is, the better interest rate you’ll qualify for because a lender will see you as a lower risk borrower. Your monthly payments will be less, and the lower interest rates will end up saving you a significant amount of money over the lifetime of the mortgage.

-

3. Do you plan to own this home for a while? Besides making sure that you can afford a home, you should also consider how long you intend to stay in one place. Most financial experts agree that living in a home for 5 years before selling makes the most financial sense. There are a lot of one-time costs involved with buying and selling so make sure you’ve factored that into your consideration. If you don’t have a 5-year plan, then it may not be the most ideal time to buy. Or make sure that your purchase is much lower than what you can afford so if you decide to move quickly, you’ll be able to do it even if you get hit with a loss.

Another important thing to consider is what the local market looks like.

Here are a few things to research before buying a home.

-

1. Browse listings in your neighborhood/area to find out what prices are like for similar homes. Websites such as Realtor.com, Zillow, and Trulia are helpful online resources for researching local markets.

-

2. Get a comparative market analysis. A CMA will give details like active listings on the MLS (Multiple Listing Service), square footage, location, lots sizes and other selling points for specific properties, information about listings already sold and what buyers paid for those properties. Investopedia describes a CMA as “an estimate of a home’s price used to help sellers set listing prices and help buyers make competitive offers.”2Contact a local real estate agent or broker to get a CMA for the area you’re considering buying in.

-

3. Check what sales prices have been like over time. By looking at prices today compared with prices from a year or two ago you will see the trends in that specific area and can see if houses are significantly higher priced than a couple of years ago and the market is in a bubble or if there is a dip in prices and it’s a great time to buy.

Should I sell now?

Many are asking if this is a good time to sell. There are several things that could make selling now a good decision.

-

1. Are you ready to downsize? It may be more budget friendly to downsize as opposed to maintaining a larger more expensive home. For older homeowners it may actually be necessary to go from a two story home to one level so they avoid stairs. Or to find a new home that doesn’t require constant maintenance and repairs.

-

2. Is there a supply shortage? Currently the US is experiencing a housing shortage across the country. “ Home prices are up more than 30% over the past couple of years, making homeownership unaffordable for millions of Americans. Rents are rising sharply too. The biggest culprit is this historic housing shortage. Strong demand and low supply mean higher prices. Part of the problem goes back to the last housing crash, which happened around 2008. After that, many homebuilders went out of business, and economists say we didn't build enough for a decade.”3 When supply is short you have a better chance to sell your home for a higher price and then can use that to put into your next home.

-

3. Do you need to re-locate? If you receive a new job offer and need to move, selling may not be an option, but a necessity. In this case the decision is easy and you can maximize in this market to sell high and find something in your price range in a new location.

Should I wait?

While there are pros and cons with buying or selling a home right now, ultimately you have to consider your own needs and goals and evaluate what makes the most economic sense for you. Here are some questions that might help you decide waiting is your best option for now.

-

1. What does my financial situation look like? Before buying a home you want to make sure your credit score is good. If it is not up to par, it may be better to wait and work on improving this number. If you don’t have a significant down payment you may also want to wait and look for ways you can save so that you can get a better mortgage rate. Consider canceling monthly expenses you may be paying and not utilizing, like monthly subscriptions & fees. Or pay off credit cards so you aren’t incurring large interest fees.

-

2. Will this deplete all my savings? If buying now leaves you with no extra money in your savings account, you may want to wait. If the economy gets worse or you lose a job you don’t want to have wiped out all your savings. “Most financial experts recommend that you have somewhere between three months and six months of basic living expenses in your emergency fund. The three-month guideline is generally recommended for those who are in salaried positions and have more secure employment. The six-month recommendation is for those who have less stable employment or earn variable incomes.” 4

-

3. What is the condition of my home? If you have a large list of repairs needing to be competed, you would be better off waiting to sell until you get the work done. When you list your home, it needs to be in top shape and look appealing. Unfinished projects can be a turn off to potential buyers. It’s always a good idea to finish any home improvement projects before putting your home on the market to secure the highest price.

The Bottom Line:

If you’re wanting to be a homeowner but hoping to wait out the high prices, you may be waiting a while. The good news is prices can’t go up indefinitely. However, the reality is it is still a strong seller’s market. There is high buyer demand and continued supply shortages, making it a good time to sell your home, if you’re ready. If interest rates continue to go up, some buyers may decide to step back and wait it out. Buying or selling may also be best decided based on your current goals and finances. So be sure to research all your options before making a decision to buy or sell so that you can make an informed choice based on your specific financial situation.

If you need to talk to an expert to evaluate your options, feel free to reach out to us today for a free consultation.

1.

https://www.bankrate.com/real-estate/

2.

https://www.investopedia.com/articles/

4.

https://www.moneyunder30.com/

6.

https://time.com/nextadvisor/mortgages/

7.

https://www.washingtonpost.com/

8.

https://www.nj.com/sellmyhome/

9.

https://www.trulia.com/guides/

10.

https://www.rocketmortgage.com/learn/

Mario Gonzalez

How To Get The Best Mortgage Rate Possible

For many years mortgage rates have been abnormally low. But in 2022, inflation and economic uncertainty caused markets to rise and fall sending mortgage rates on a roller coaster. Even the experts are divided when it comes to predicting where rates are headed next.1

When markets are volatile, it is concerning for homebuyers and sellers, and according to MarketWatch.com, interest rates very well could continue rising, so now might be a good time to lock in your rate before rates go up again. With a little planning you can improve your chances to qualify for the best mortgage rate available – and open up the possibility of refinancing at a lower rate in the future.

Your interest rate has a significant impact on your monthly payment, and can save you lots of money over the course of your 30 year mortgage.

Let’s compare a 5.0% versus a 6.0% fixed-interest rate on a $500,000 home, over a 30-year term. 2

|

Mortgage Rate |

Monthly Payment on $500,000 Loan |

Difference in Monthly Payment |

Total Interest Over 30 Years |

Difference in Interest |

|

5.0% |

$2,430 |

|

$419,651 |

|

|

6.0% |

$3,168 |

+ $738 |

$571,271 |

+ $151,619 |

With a 5% rate, you would save $738 per month on your monthly mortgage. Over the course of a 30 year period, your savings would be $151,619! In other words, shaving off just one percentage point on your mortgage could put nearly $150K in your pocket over time.

So, how can you get the best interest rate available? Here are eight tips to help you save money:

1. Maintain a Steady Job.

Steady employment is a key indicator of stability, and credit companies like to know you are reliable. If you are preparing to purchase a home, you probably don’t want to make a major career move. Job moves or gaps in your résumé could hurt your credit score and borrowing ability.

Mortgage lenders will typically review the last 24 months of your employment and income.5 If you’ve had a steady job with a consistent paycheck, you will qualify for a better interest rate.

Don’t be afraid of accepting a promotion, or even changing companies, as long as you can show a consistent monthly income. But some moves, like switching from W-2 to 1099 (independent contractor) income, could impact your home borrowing plans more than others.6

2. Increase your credit score.

A high credit score means you’re seen as a safer option for lenders. You have a

track record of paying your bills on time and don’t overextend your

financial resources. When lenders pull your credit, they see you as

a responsible borrower with a low risk of mortgage default.3.

Borrowers with higher credit scores are offered lower interest rates. A

good credit score is between 690 and 800.4 If you don’t know

your score, check with your bank or credit card company to see if they

offer free access.

If your credit score is low, you can improve it using the following steps, including:4

-

Correct any errors on your credit reports, this will instantly improve your score. AnnualCreditReport.com provides a free resource to do this.

-

Reduce the amount of debt you currently owe. Start with credit cards, and any home equity lines of credit.

-

Keep old credit card accounts in good standing open. If you close old accounts it could lower your score by shortening your credit history and shrinking your total available credit.

-

Make sure all your payments are on time. Payment history is a top factor to determine your credit score.

-

Avoid additional credit applications when you are searching for a home mortgage. You can ding your score by having too many credit inquiries. If you’re shopping around for a car loan, limit your applications to a short period, two weeks is best.5

Over time, if you follow the steps above, your credit score will increase over time. This will help you qualify for a lower mortgage rate.

3. Reduce your debt-to-income ratios.

Even if you have a high credit score and a great job, lenders will be concerned if your debt to income ratio is to high. The more debt you have, the lower amount you can afford for your mortgage. If you want that expensive house, make sure you reduce your debt before applying for your mortgage.

There are two types of DTI ratios:7

-

Front-end ratio — the percentage of your gross monthly income that will go towards covering housing expenses (mortgage, taxes, insurance, and dues or association fees). A good front-end DTI ratio is 28% or lower.7

-

Back-end ratio — The percentage of your gross monthly income will go towards covering ALL debt obligations (housing expenses, credit cards, student loans, and other debt). A good back-end DTI ration is usually 36% or less.7

You can reduce your DTI ratios by reducing the cost of your home purchase, or, increasing the size of your down payment. If your back-end ratio is too high, make sure you pay down your existing debt. You can also increase your monthly income. Keep in mind, two income families have an advantage. Make sure you include your income from both parties when applying for your loan.

4. Increase your down payment.

Why do mortgage lenders care about your down payment size? Because home buyers with significant equity in their homes are less likely to default on their mortgages.

If you can afford it, it is highly recommended to put 20% down payment on

your home. Having 20% equity in your home will reduce your interest rate

on your mortgage, and it will remove the Private Mortgage Insurance that

Conventional Lenders require if your equity is less than 20%.8

A larger down payment will also lower your overall borrowing costs and decrease your monthly mortgage payment since you’ll be taking out a smaller loan. Just be sure to keep enough cash on hand to cover closing costs, moving expenses, and any furniture or other items you’ll need to get settled into your new space.

5. Pick the right loan type.

There are different types of mortgages. The loan type you choose could save (or cost) you money depending on your credit score, employment history, and down payment size.

For example, here are several common loan types available in the United States today:9

-

Conventional — These offer lower interest rates but have strict credit requirements and down payment requirements.

-

FHA — These loans are backed by the government, and are easier to qualify for, but typically have higher interest rates.

-

Specialty — Certain specialty loans, like VA or USDA loans, are available to you if you meet certain requirements.

-

Jumbo — Jumbo mortgages are large loans that exceed the local conforming loan limit, and are subject to additional requirements and usually have higher interest rates.10

When evaluating loan types, you’ll also want to consider the pros and cons of a fixed-rate versus variable-rate mortgage:11

-

Fixed rate — With a fixed-rate mortgage, you are guaranteed to keep the same interest rate for the entire life of the loan. Fixed rate mortgages are the most popular loan type, because they are stable, and predictable.

-

Adjustable rate — Adjustable-rate mortgages, or ARMs, offer home buyers a lower introductory interest rate than fixed-rate mortgages, but the rate can rise after a set period of time — typically 3 to 10 years.

According to the Mortgage Bankers Association, as of September 2022, 10% of American homebuyers are selecting ARM mortgages. This is up from 4% at the start of 2022.12 If you are planning to sell your home before the rate resets, an ARM might be a good option for you. Or, if you think rates are going to decrease in the future, an ARM might be worth considering.

6. Shorten your loan term.

A mortgage term is the length of time your mortgage agreement is in effect. The terms are typically 15, 20, or 30 years.13 Although the majority of homebuyers choose 30-year terms, if your goal is to minimize the amount you pay in interest, you should crunch the numbers on a 15-year or 20-year mortgage.

With shorter loan terms, the risk of default is less, so lenders typically offer lower interest rates.13 Just make sure you can afford your monthly payments before selecting a shorter mortgage term.

7. Compare interest rates from multiple lenders.

When shopping for a mortgage, be sure to get quotes from different lenders

and lender types to compare the interest rates and fees. Some Lenders may

offer a better deal for the type of loan and term length you want.

Some borrowers choose to work with a mortgage broker. Like an insurance

broker, they can help you gather quotes and find the best rate. However,

if you use a broker, make sure you understand how they are compensated and

contact more than one so you can compare their recommendations and

fees.14

If you are working with a builder, frequently offer interest discounts if

you work with their lender. This can be a bit risky however, make sure you

understand how they are compensated, and make sure there are no surprises.

When dealing with such a large transaction, I personally prefer and

recommend to hire a lender who works directly for you.

Don’t forget that we can be a valuable resource in finding a lender, especially if you are new to the home buying process. After a consultation, we can discuss your financing needs and connect you with loan officers or brokers best suited for your situation.

Getting Started

The historically low interest rates we saw during the height of the pandemic are behind us. However, today’s 30-year fixed rates are still far below the historical average of 8%, and are well below the all-time high of 18.45% in 1981.16

And although higher mortgage rates have made it more expensive to finance a home purchase, they have also eliminated some of the competition from the market. As a result, today’s buyers are finding more homes to choose from, with less competition, and more sellers are willing to negotiate or offer incentives to sell their home. This makes it still a perfect time to review your finances in detail and determine the pulse of the city/neighborhood you are interested in.

If you’re ready to buy a home, there’s no reason that concerns about mortgage rates should keep you from moving forward with those plans. The reality is that many economists predict continued rate hikes and that home prices will also continue to rise.18 So you may be better off buying today at a slightly higher rate than waiting and paying more for a home a few years from now. You can always refinance if mortgage rates go down, but you can’t make up for the lost years of equity growth and appreciation.

If you would like more information about buying or selling a home or have any questions, please contact us to schedule a free consultation. We’d love to help you weigh the pros and cons in this ever-changing market and reach your real estate goals!

Sources:

-

Mortgage Calculator -

https://www.mortgagecalculator.org/ -

RocketMortgage –

https://www.rocketmortgage.com/learn/what-is-a-credit-score -

Chase Bank -

https://www.chase.com/personal/mortgage/education/ financing-a-home/ ways-to-reduce-mortgage-rates -

Experian -

https://www.experian.com/blogs/ask-experian/ how-to-get-lower- mortgage-interest-rate/ -

CNBC -

https://www.cnbc.com/2022/07/11/mortgage-rates-have- surged-heres-how-to- get-a-lower-rate.html -

Nerd Wallet -

https://www.nerdwallet.com/article/mortgages/ get-the-best-mortgage-rates -

NerdWallet -

https://www.nerdwallet.com/article/mortgages/ payment-buy-home -

Consumer Financial Protection Bureau -

https://www.consumerfinance.gov/owning-a-home/ loan-options/ -

NerdWallet -

https://www.nerdwallet.com/article/mortgages/ jumbo-loans-what-you-need-to-know -

Bankrate -

https://www.bankrate.com/mortgages/arm-vs-fixed-rate/ -

Consumer Financial Protection Bureau -

https://www.consumerfinance.gov/owning-a-home/loan-options/ #anchor_loan-term_361c08846349fe -

Rocket Mortgage -

https://www.rocketmortgage.com/learn/buydown-mortgage -

Bankrate -

https://www.bankrate.com/mortgages/mortgage-points/ -

CNBC -

https://www.cnbc.com/select/mortgage-rates- today-still-relatively-low/ -

Rocket Mortgage -

https://www.rocketmortgage.com/learn/historical-mortgage- rates-30-year-fixed

Mario Gonzalez

How to Write a Winning Offer

We’ve all seen how quickly houses are disappearing these days. When you find a home you are interested in you need to be prepared to make a quick offer. Having a plan is important to giving you a fighting chance. An experienced agent can help you look at the risks and benefits and prepare an offer that will be competitive. Below are several things you can think about and consider when writing an offer.

-

Show that you have reliable financing

A seller and their agent want to ensure that the deal will go through. They don’t want to waste time on a buyer whose mortgage application is going to fall apart. Having a pre-approval letter is one of the best ways you can show your seriousness about purchasing a home. You’ve gone through the time and effort of finding a reliable lender that has given a pre-stamp of approval on your loan. Some lenders are more reputable than others or specialize in specific types of loans so whatever your situation is, make sure you’ve done your homework and secured pre-approval from a reputable lender that a seller agent will be happy to work with.

-

Prepare to put down a decent deposit

Having a decent deposit shows the seller you are serious about buying. It is a bit risky because you won’t get earnest money back if things fall through, but it speaks volumes to the seller and their agent that you confident of your ability to secure a loan and prepared to follow through with your intention of buying the property.

-

Don’t ask for too many contingencies

A buyer often wants to put a lot of contingencies in place, and understandably so. But if you have too many contingencies listed in your offer, a seller may be more inclined to pass you by and choose someone else. Some of the contingencies often put into an offer are an appraisal, a home inspection, financing, and offer based on the buyer’s home selling. These are all important and legitimate contingencies to include, however, a seller may be more inclined to accept an offer from someone that has fewer or no contingencies. There are obviously risks to a no contingency offer, but depending on the specific home, we can help you evaluate the risks/benefits involved prior to submitting an offer.

-

Offer flexible closing date and lease back options

Everyone has different reasons for selling their homes and sometimes money may not be their primary motivation for accepting an offer. For example, someone may want to sell their home but take their time looking for a new home, so having a lease back option on the table may be appealing to them. Or maybe they need flexibility with the new home they are buying so a flexible closing date would be preferable. You never know what the seller’s situation is so talking with the seller agent and finding out their preferences can help you make an offer that appeals to their specific situation.

-

Work with an experienced buyer’s agent

Today the real estate market is extremely competitive, and it greatly benefits you to have a professional real estate agent on your side to help you navigate the home buying process and lower your risk of unexpected surprises. An agent that will be your advocate and has your best interest in mind can help you prepare an offer letter that will appeal to the seller and their agent. A seller’s agent appreciates working with a kind, respectful and knowledgeable agent that they can trust will show up on closing day with everything in place and all the correct paperwork signed and ready to go.

If you are looking to buy a house and you want to make sure you have a strong chance to be considered, please reach out and schedule a consultation. We’d love to lend our expertise and be your advocate to help write a winning offer that will give you the best chance at buying that home of your dreams.

https://www.sfgate.com/

Mario Gonzalez